Loan Mentor

Example Situation:

Say you are looking to buy a home and need a mortgage. You have a good credit score and a stable income, but you're not sure where to start.

Solution

1 - Assess Your Financial Situation: The first step is to understand your debt-to-income ratio (DTI), which is all your monthly debt payments divided by your gross monthly income. Lenders use DTI to evaluate your ability to manage monthly payments and repay the money you want to borrow for a mortgage. Ideally, your DTI should be below 36%, but some lenders may allow up to 43-50% depending on the loan type.

2 - Check Your Credit Report: Make sure there are no errors on your report that might be dragging your score down.

3 - Save for a Down Payment: The more you can put down, the less you need to borrow, and the cheaper your mortgage is likely to be. There are loans available for as little as 3.5% down, but putting down 20% will prevent you from having to pay private mortgage insurance (PMI).

4 - Get Pre-Approved: Before you start house hunting, get a mortgage pre-approval. This will give you a clear idea of how much a lender is willing to finance and will show sellers that you are a serious buyer with financing already in place.

5 - Compare Loan Types: There are various kinds of mortgages like conventional loans, FHA loans, VA loans, etc., and they all come with different requirements and benefits.

6 - Shop Around: Get quotes from several lenders including banks, credit unions, and online lenders. Each may offer different rates and fees, so shopping around could save you a significant amount of money over the life of your loan.

7 - Consider Both Rates and Fees: The interest rate isn't the only thing that affects the cost of your mortgage. Be sure to also compare fees, including origination fees, closing costs, and any other lender charges.

8 - Negotiate: Remember that some fees and rates are negotiable. Don't be afraid to ask lenders to give you a better deal

9 - Read Reviews and Check Ratings: Look for customer reviews and check regulatory agencies for any complaints against the lenders you are considering. A low rate is great, but not if it comes from a lender with poor customer service and support.

Looking for a loan but don't know where to start? Lucky for you, you're not alone!

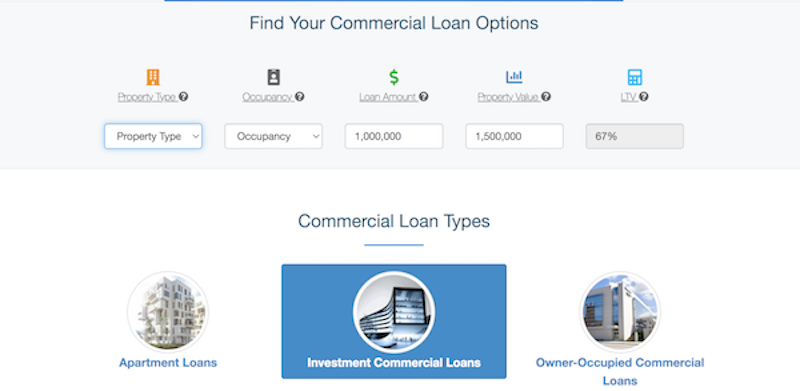

Compare some of the leading loan companies in the industry and find the best loan for you! Companies such as Commercial Loan Direct offer calculators to help you determine how much you can afford to borrow and what type of loan fits your needs. Just input the details of your small business, commercial, or appartment loan you are looking for and the calculator will help you understand your options. Loan Mentor is here to help!

Commercial Loan Direct

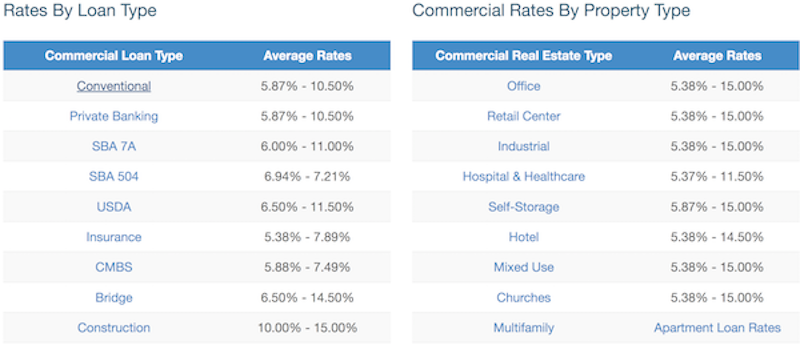

Commercoal loan rates provided by Commercial Loan Direct:

The Benefits of using CLD:

"Not only can Commercial Loan Direct save you time by searching hundreds of loan programs for you, but we can also save you money. Because we have access to various financial institutions wholesale programs, we can offer you the most competitive interest rates with no up-front fees and reduced financing costs. We can also help you to build a real estate portfolio that maximizes your returns, whether that means financing for a long term hold, a short term flip, or any other specialized structure. We can even help you to finance your next construction project." - Commercial Loan Direct website*

Affiliate Link here pending approvalFor now feel free to click here and check out my programming portfolio website

If you appreciate the resources and information provided herein, please use my affiliate link above to apply for a loan.

There will be no additional cost to loan applicants based on this, however it will help an independent programmer

achieve another step toward financial independence. For anyone who uses the link below and applies through their website,

I will not receive any support for this goal, however my primary purpose is to create a hub full of useful information.

So if you are grateful, please feel free to use their site then return here to apply for a loan through my link. Either way, thank you!

-Sequoia Kanies